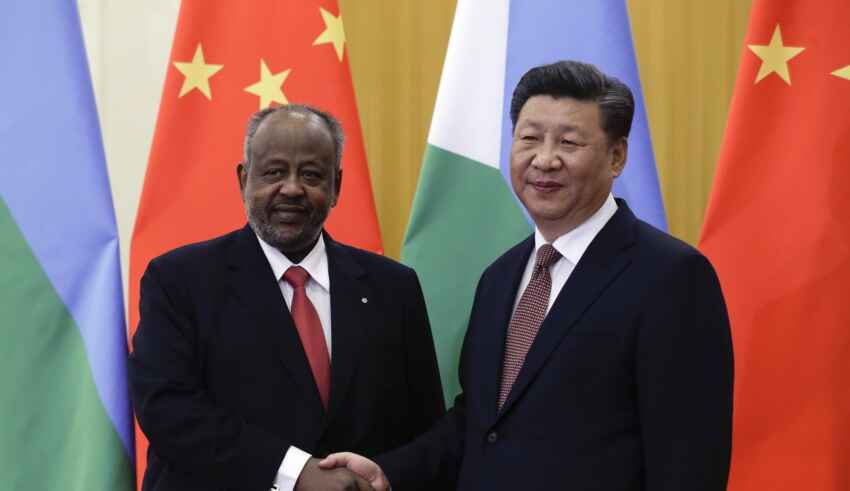

Chinese investments in Africa have been significant over the last few decades, primarily focused on infrastructure, natural resources, and trade. Overall, Chinese investment in Africa has been viewed both positively and negatively, with some experts arguing that it has contributed to African economic development, while others argue that it has led to exploitation and increased dependency.

There are several other countries that invest in Africa, but the top investors are often considered to be the United States, France, the United Kingdom, and India. There is an overlap for most of these countries’ investments in natural resources, infrastructure, and energy. It is worth noting that the extent of investments by these countries varies depending on factors such as economic conditions, political stability, and the availability of investment opportunities in individual African countries.

The impact of Chinese investments on local communities can be both positive and negative, depending on various factors such as the nature of the investment, the way it is implemented, and the level of community engagement. Some of the positive impacts of Chinese investment on local communities in Africa can include job creation, improved infrastructure, and increased trade. On the other hand, some of the negative impacts of Chinese investment on local communities in Africa can be listed as environmental degradation, displacement of local communities, and exploitation of resources. It is important to note that the effects of Chinese investments on local communities can vary greatly depending on the specific investment and the local context. In some cases, the negative impacts can outweigh the positive impacts.

There have been concerns about the negative environmental consequences of Chinese investments in Africa, including water, soil and air pollution, deforestation, and great levels of contribution to climate change. Criticisms against Chinese investments in Africa for their negative environmental impacts have been raised in a large range. For instance, the Zambia-China International Copper Mine Project has been linked to water pollution in the region due to high levels of waste from the mine contaminating local rivers and affecting the health of local communities. Another example can be the Ethiopa-China Suga Plantations Project. The development of large-scale sugar plantations in Ethiopia by Chinese companies has been linked to deforestation and land degradation, with local communities being displaced from their homes and lands.

It is important to note that not all Chinese investment projects in Africa have negative environmental impacts and that some projects are being implemented in a more sustainable and responsible manner. However, it is crucial to assess the environmental impact of these investments and to implement measures to mitigate negative consequences and promote sustainable development.

It is common for discussions about Chinese investments in Africa to be influenced by the Eurocentric perspectives because of the colonial past of Europe and Africa, as well as the continued economic, political, and cultural influence of the Western countries in the region. China has been criticized for the key areas of its investment being utilitarian. In many discussions, the focus is often on the perceived negative effects of Chinese investment in Africa, such as the exploitation of resources, loss of sovereignty, and environmental degradation. This Eurocentric perspective can lead to a narrow and incomplete understanding of the dynamics of Chinese investment in Africa.

It is important to consider the perspectives of African countries and their citizens in discussions about Chinese investment in Africa, as they are the primary stakeholders and the ones who are most directly impacted by these investments. A more inclusive and nuanced approach to these discussions can help to provide a more complete understanding of the complex dynamics of Chinese investment in Africa.

The attitudes of African governments towards Chinese investments are complex and vary greatly between countries and regions. For instance, the Ethiopian government has welcomed Chinese investments, particularly in infrastructure development and manufacturing, as a means of boosting economic growth and reducing poverty. Also, the Angolan government has also been supportive of Chinese investments, particularly in the oil and gas sector, as a means of financing economic development and creating jobs.

However, there are also African governments that have been less supportive of Chinese investments. Concerns are related to growing debts and very possible dependence on Chinese investments, negative environmental impacts of Chinese investments, and poor working conditions and labor rights in Chinese-owned companies.

In recent years the Zambian government has become increasingly critical of Chinese investments and has raised concerns about the level of debt and the terms of loans provided by China. Also, the South African government and civil society groups have raised concerns about the impact of Chinese investments on local industries and job creation. The Nigerian government too, has raised concerns about the environmental impacts of Chinese investments, particularly in the extractive industries, and the lack of transparency in investment deals.

Another, maybe the most popular, example of African countries becoming more cautious and vigilant against the potential negative impacts of Chinese investments is the dismissal of the project of The Nairobi-Mombasa Standard Gauge Railway which was to be funded by the Chinese government. The project faced opposition from environmental activists who argued that it would negatively impact sensitive ecosystems and wildlife habitats along the route. In 2018, a Kenyan court ruled that the environmental impact assessment carried out by the government was insufficient and that the project would cause significant harm to the environment, leading to the project being dismissed. The decision was seen as a victory for environmental protection and as a sign of growing opposition to large-scale development projects that do not take into account their potential impact on the environment and local communities.

China has pursued investments in a number of African countries that are facing political, security, or economic challenges in line with its broader investment strategy which seeks to access new markets and resources and increase its global influence. In the cases of Sudan, South Sudan, and the Democratic Republic of Congo, China’s investments have been criticized for being insensitive to the local political and social situation and for exacerbating the existing conflicts or tensions.

Foreign investments which are solely aiming for economic and political gains of the investing countries stand as one of the biggest obstacles to the sustainable development of the African region. The negative consequences of Chinese investments in Africa can be reduced or eliminated through a variety of measures including improving transparency and accountability, increasing local consultation and engagement, environmental and social impact assessments, capacity building, and improving regulatory frameworks. These measures should be taken not only by the Chinese investors but by all the investors to avoid negative consequences in order to consolidate sustainable development in the African region. Therefore, investments in crucial areas such as education, research and development, and high technology should be centralized in the economic engagement with the region.

By The European Institute for International Law and International Relations.